When it comes to home improvement, flooring is one of the most significant investments you’ll make. Whether you’re renovating your entire home or refreshing a single room, understanding your payment options for floor decor is essential. Along my journey of choosing flooring solutions, I discovered a wealth of options, payment strategies, and financing plans that made my experience smoother. In this article, we’ll explore everything you need to know about floor decor payment options, helping you make informed decisions for your home.

Understanding Floor Decor Payment Options

Choosing the right flooring is only half the battle; figuring out how to pay for it is just as crucial. From cash payments to financing plans, there are multiple avenues to consider.

1. Cash Payment

Paying cash for your flooring might seem like an attractive option. It can help you avoid interest payments or financing fees.

Pros and Cons of Cash Payments

| Pros | Cons |

|---|---|

| No interest fees | Large upfront payment required |

| Full ownership upon purchase | Depletes savings |

| Faster transaction process | Limited flexibility |

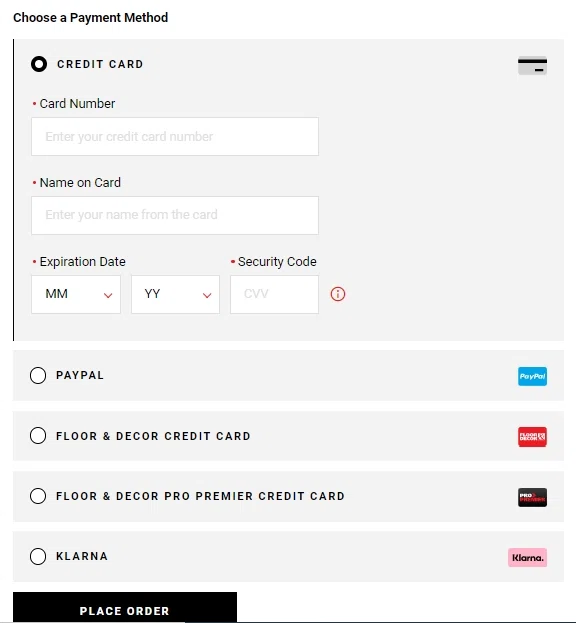

2. Credit Cards

Using credit cards can be a flexible way to finance your flooring purchase. However, it’s vital to consider interest rates and repayment terms.

Pros and Cons of Credit Card Payments

| Pros | Cons |

|---|---|

| Rewards points or cashback | High-interest rates |

| Immediate availability of funds | Potential for debt accumulation |

| Flexible repayment options | Impact on credit score if not paid on time |

3. Personal Loans

Taking out a personal loan for your flooring project may offer lower interest rates than credit cards. It’s essential to assess your credit score and loan terms.

Pros and Cons of Personal Loans

| Pros | Cons |

|---|---|

| Fixed monthly payments | Origination fees may apply |

| Lower interest rates than credit cards | Potential impact on credit score |

| Can cover large amounts | Longer approval process |

4. Floor Decor Financing Options

Many flooring retailers offer financing options that can simplify your payment process. These plans often come with promotional periods, allowing you to pay off your purchase without interest if completed within a specified timeframe.

Pros and Cons of Retail Financing

| Pros | Cons |

|---|---|

| Often promotional interest-free periods | Deferred interest may apply |

| Convenient application process | Higher overall costs if not paid off quickly |

| May offer low or no down payment | Monthly payments required |

5. Home Equity Loans

If you have equity in your home, a home equity loan or line of credit (HELOC) can provide the funds needed for flooring renovations.

Pros and Cons of Home Equity Loans

| Pros | Cons |

|---|---|

| Lower interest rates than unsecured loans | Risk of foreclosure if unable to repay |

| Potential tax deductions on interest | Requires appraisal and closing costs |

| Access to a large sum of money | Longer approval process |

How to Choose the Right Payment Method for Your Floor Decor

Deciding how to pay for your flooring can be daunting, but it doesn’t have to be. Here are some tips based on my personal experiences to help guide you through this process.

Evaluate Your Financial Situation

Before selecting a payment method, assess your overall financial condition. Determine your budget, consider your savings, and understand your credit score. This analysis will guide you in choosing the most suitable financing option.

Consider Your Future Plans

Think about how long you plan to stay in your current home. If you’re planning to sell soon, it might make sense to keep costs low. However, if you’re committing long-term, investing in high-quality flooring with a suitable financing option may pay off in the long run.

Research and Compare Options

Don’t settle for the first financing option you find. Research multiple lenders and retailers to compare interest rates, terms, and additional fees. Leveraging competition can help you secure more favorable conditions.

Read the Fine Print

Understanding all terms and conditions is crucial. Read the fine print of any financing agreement to avoid hidden fees, high-interest rates, or unfavorable terms.

Tips for Managing Flooring Payments

Once you’ve secured a payment method, managing your finances becomes the next priority. Here are some tips I’ve found helpful:

Create a Budget

Plan a budget that accounts for your flooring payment along with other essential expenses. This ensures you don’t overspend or fall behind on payments.

Automate Payments

Setting up automatic payments can alleviate the stress of managing due dates. It ensures you never miss a payment, which can help maintain a good credit score.

Review your Progress Regularly

Keep track of your payments and review your financial situation regularly. Adjust your budgeting strategy if necessary to stay on track.

Frequently Asked Questions (FAQs)

What financing options are available for flooring?

Common options include cash payments, credit cards, personal loans, retailer financing, and home equity loans. Each has its unique advantages and considerations.

How do I find the best flooring payment option?

Evaluate your financial situation, consider your future plans, research and compare options, and read the fine print of any agreements.

Is it better to pay for flooring in cash or finance?

This depends on your financial situation. Cash payments can save on interest, while financing may allow you to maintain savings for emergencies or investments.

Can I negotiate financing terms?

Yes, don’t hesitate to negotiate terms with lenders or retailers. They may offer better rates or conditions to ensure you choose their services.

What happens if I miss a flooring payment?

Missing a payment can lead to late fees and a negative impact on your credit score. It’s essential to communicate with your lender if you face difficulties in making payments.

Conclusion

Understanding your options for floor decor payment can significantly impact your home renovation experience. By exploring the various financing methods, carefully assessing your situation, and managing your payments wisely, you can make flooring decisions that enhance your home’s beauty without straining your wallet. Remember, the right flooring not only elevates your space but also boosts your property’s value. Take your time, do your research, and find the option that best suits your needs!

Final Thoughts

Investing in flooring is a decision that can transform your home. With the right payment strategy in place, you can enjoy your new floors without the financial burden. Happy decorating!